Introduction

Liquidity Providers are essential to decentralized prediction markets. Before forecasters can buy and sell outcome shares in a prediction market, markets are required to have liquidity.

The more liquidity is present in a market, the lesser the price impact when buying or selling outcome shares, and therefore more accurate is the forecast provided by that market.

The benefits of adding liquidity to markets powered by Polkamarkets are the following:

- Liquidity Providers can earn a Liquidity Providers Fee from every buy/sell transaction. By default, this fee is set to 2%, but the Market Creator can set it to 0% or 5%.

- The top Liquidity Providers are eligible for weekly rewards through the Protocol Incentives program.

There are, however, risks associated with providing liquidity that must be well understood before deciding to add liquidity to a prediction market:

- risk associated with receiving outcome shares, the value of which fluctuates, as part of the total stake when adding or removing liquidity to and from a market;

- risk of near-total loss, as ultimately the value of the shares of one of the outcomes will go to 0 after the market resolves;

- when a market’s Liquidity Provider Fees are set to 0%, a Liquidity Provider will have an even smaller chance of offsetting this risk.

The following sections in this article will help better understand the risks and what strategies to adopt to increase the likelihood of being a successful Liquidity Provider.

You’re welcome to join the Polkamarkets community on Discord to ask questions and debate strategies.

Introduction to the liquidity mechanism

The Polkamarkets Protocol uses an Automated Market Maker (AMM) system adapted to the Prediction Markets use case. As with other AMM-powered systems, such as Uniswap or other DEXes, Liquidity Providers who use the Polkamarkets Protocol must implement strategies to deal with the risk of loss.

Importantly, due to the zero-sum nature of prediction markets, the risk is greater than that incurred with other AMMs, as you’re risking near-total loss, rather than impermanent loss.

At the moment of market creation, the initial Liquidity Provider’s stake is converted to liquidity shares.

If the price of all outcomes in the market is equal, the Liquidity Provider receives 100% of all Liquidity Pool Shares. The initial Liquidity Provider only receives liquidity shares in return for their liquidity, and does not receive any outcome shares. This is the case anytime that the price of both outcomes is equal. In this scenario, removing liquidity also returns 100% of the funds put in as liquidity.

When the price of the outcomes is unequal, however, this changes:

- When adding liquidity to the market, the Liquidity Provider will receive a portion of their stake in liquidity shares, and another portion in shares of all outcomes, except for the least likely outcome at that moment (ie. the outcome with the lowest price).

- When removing liquidity, they will receive a portion of their stake as shares of all outcomes except for the most likely outcome (i.e.. the outcome with the highest price).

Make sure you read the articles about Trading and Price Calculation and Market Liquidity to learn more about these mechanisms in detail.

The best moments to add liquidity to a market

The very best moment to add liquidity to a market is at creation time, or at any time when the outcome prices are even. At this point, Liquidity Providers only receive shares of the Liquidity Pool and are therefore not directly exposed to the variation of Outcome prices

The second best moment to add liquidity to a market is when the price of the most likely Outcome is not close to 1, and that a Liquidity Provider believes that the most likely Outcome will be the winning Outcome. Given that the Liquidity Providers will receive a part of their stake back in Outcome shares, they will want to maximize the earning potential of the Outcome shares that they receive.

The rule of thumb should be to, as a Liquidity Provider, only add liquidity to a market when:

- the current most likely Outcome is the one that the Liquidity Provider believes will be the winning outcome, and

- the Liquidity Provider believes that the Outcome it is under priced at the moment that they add liquidity (i.e.. its price will increase over time).

Inversely, the worst moments to add liquidity to a market are:

- When the Liquidity Provider believes that the most likely outcome is overpriced (i.e.. its price likely to decrease over time).

- When the Liquidity Provider believes that the incoming trading volume on a market will be too low to compensate for the risks (more on this in the last section).

The best moments to remove liquidity from a market

The most important rule of thumb is that a Liquidity Provider should always remove the liquidity they added before the market closes, if the outcome prices are uneven (which is almost always the case).

Since the Liquidity Provider will always receive shares of the least likely outcomes when the outcome prices are uneven, if the Liquidity Provider removes their liquidity after the market expires, they won't be able to sell their shares. Shares of the losing outcomes will be worth 0.

The Liquidity Provider should aim to sell their shares of the least likely outcomes, which they always receive when they remove liquidity. They can only do this if they remove liquidity before the market expires, and therefore receive their shares of the least likely outcomes while the market is still open for trades.

Other than this, you always need to consider the outcome prices and how you think they will evolve.

As a Liquidity Provider, it's likely that you hold shares of the most likely outcome. So assess if you think the outcome is underpriced or overpriced.

If you think it's overpriced, then this might be a good moment to sell your shares, remove your liquidity, and hold on to the shares of least likely outcomes, which would logically be underpriced and therefore likely to gain value.

If you think the most likely outcome is underpriced, then you might want to consider whether you should increase either your liquidity position, or your position in that outcome. Always remember that you will receive shares of the least likely outcome when you remove your liquidity from the market, and will you have to offset that risk with your shares of the most likely outcome.

Other than the considerations related to outcome shares, consider the rewards coming from the Liquidity Providers Fee. Read the section below to learn more about the relationship between trading volume and profitability for liquidity providers.

Benefiting from volume

For liquidity provisioning to be more beneficial, the market must have a non-zero Liquidity Provider Fee and several times more trading volume than it has liquidity.

The more buy and sell transactions happen on the market, and higher the Fee, the more rewards are earned by the Liquidity Providers.

Market Creators and Liquidity Providers should carefully consider whether a given market is likely to be of interest to a high enough number of participants, which should increase the chances of it generating a high trading volume.

It is in the best interest of Market Creators and Liquidity Providers to actively promote the markets they participate in to attract more forecasters who will contribute with more trades to their markets.

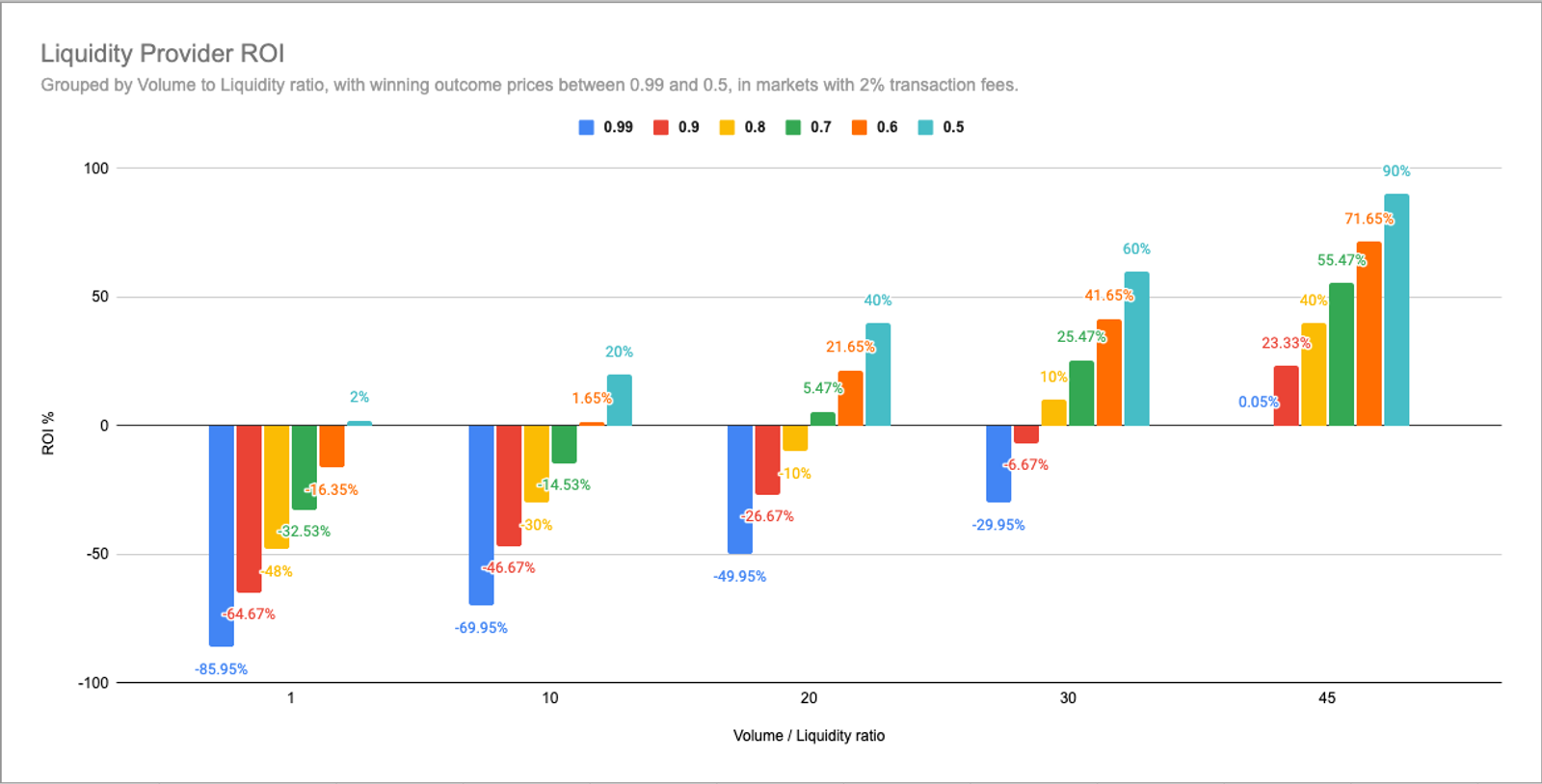

Example: The following graph shows the return on investment (ROI) of providing liquidity given different trading volume scenarios. The data assumes that:

- liquidity is provided at the time of market creation, when the outcome prices are even (0.5 for outcome A and 0.5 for outcome B)

- the fee awarded to liquidity providers is 2%

Looking at the two extreme scenarios presented in the chart above, we can see that:

- If the final price of the winning outcome is 0.5, the liquidity provider will always take a 2% profit, as long as the trading volume is at least identical to the amount of liquidity added to the market. For example, if there were 5 MOVR in liquidity, the trading volume must be at least 5 MOVR for the liquidity provider to earn 2% profits.

- If the price of the winning outcome is 0.99, the initial liquidity provider will only reach break-even (0.05% profitability) if the trading volume in the market is 45x greater than the market liquidity. For example, for 5 MOVR in liquidity, the trading volume must be at least 225 MOVR so that the 2% fees can compensate for the loss associated with receiving shares of the losing outcomes.

These extreme cases are very rare on Polkamarkets. The average and median closing prices of the most likely outcome tend to be comprised between 0.6 and 0.8 in markets across all categories. The exception seems to be for markets in the Crypto category, where the average closing price of the most likely outcome has been 0.89, and the median price 0.92, as of April 2022.

While the relationship between total volume and total liquidity is always true, the exact volume/liquidity ratio required for profitability will depend on the price of the outcomes at the moment when liquidity was added.

The examples above assumes that liquidity was added at market creation, when the price of both outcomes is even. The ratio becomes less demanding if liquidity is added when outcome prices are closer to the closing prices.

For instance, if a liquidity provider adds liquidity when the outcome prices are at 0.6 and 0.4, and the final price is 0.7 and 0.3, they'd need a 3x volume to liquidity ratio to break even, rather than the extreme 45x.

It's important to underline that whatever the ratio is at the moment that you add liquidity, it is that ratio that will apply all the way. If more people add liquidity, and the amount of liquidity goes up, the target volume also increases -- the ratio will stay the same.

Also note that if the fee is higher, the volume-to-liquidity ratio required to achieve profitability is smaller as well. For example, if the fee is set to 5% instead of 2%, the ratio of the extreme case where the most likely outcome is 0.99 is reduced to 18x, instead of 45x. Setting a higher fee benefits the liquidity providers, but of course hurts forecasters.